The end of the school year is on the horizon, and you’re excited for your kid to enjoy their time off—until you remember that you still have to go to work. Summer camps, including day camps, provide more than just fun; they offer child care solutions for working parents. While many daycares and babysitters provide care, day camps offer children more engaging activities. After all, summer is a time for fostering memories that will carry them through the following school year.

Then it hits you: summer camp!

Your kid can explore, innovate, and play while you’re working, offering a balance of enjoyment and eligible dependent care expenses for tax purposes.

Wait, does summer camp count as dependent care for taxes?

Yes, camps can qualify if your family meets the appropriate qualifications, which we’ll explore in depth below.

What Is The Dependent Care Credit?

If you’ve heard of the Dependent Care Credit, you probably think it’s for traditional services like daycares or babysitters.

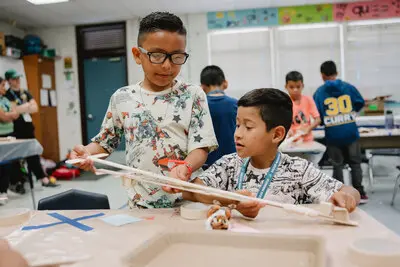

While care programs qualify, many parents and caregivers are surprised to learn that summer camps also play a role. That’s right, your child can have fun and engage in many hands-on activities or explore the world, and it will count toward the credit.

So, do all day camps and summer camps count as eligible dependent care under all circumstances?

Not all summer camps qualify (as we’ll get into detail later), but we’re happy to report that Camp Galileo can qualify for the Dependent Care Credit.

Exploring the Specifics

The Child Dependent Care Credit supports paying child care expenses for children under 13 or disabled dependents who can’t care for themselves. The main requirement is that the care must enable you to work or look for a job.

Tax credits available with Dependent Care Credit include:

- Claims of up to $3000 for one dependent, resulting in up to $1050 covered

- Claims of up to $6000 for two or more children, allowing for up to $2100 in deductions

These figures are rough guidelines, as dependent care tax credits vary with your income that year. Many families use the Child Dependent Care Credit to help manage child care expenses.

Criteria for Summer Camp as Dependent Care

Choosing the right camp, whether it be a day camp or summer camp, is key to ensuring your care expenses qualify for tax deductions under the Dependent Care Credit. While it’s exciting to get tax relief on camp expenses, remember that tax regulations are stringent and specify qualifying criteria.

Eligibility requirements for summer camp Dependent Care Credit qualification include:

- You must be the child’s main caretaker—or have primary custody and responsibility.

- The summer camp must be used as Dependent Care so you can work or look for a job.

- The kid must be under 13 years of age unless they meet disability qualifications, including being unable to care for themselves physically.

- You (or you and your spouse if filing jointly) must have earned income tax for the year.

- The childcare provider can’t be your spouse or dependents or the child’s parent.

If you meet these conditions, your summer camp expenses might qualify under the Dependent Care Credit.

Additional Information to Note

If your summer camp plan aligns with the previous criteria, it should qualify for the Dependent Care Credit. The IRS requires that only certain programs qualify as child care providers, excluding educational sessions or similar.

However, some specialty day camps focused on specific skills or interests may qualify.

- Math

- Art

- Technology

- Engineering

- Science

- Sports

Rearrange these and you’ll see STEAM hidden between. STEAM stands for science, technology, engineering, art and mathematics, and it’s the core pillar of our summertime activities at Camp Galileo.

Tax Benefits and Savings Strategies

Filing your tax return accurately is essential for maximizing savings from eligible care expenses, which includes day camp fees.

Dependent Care Tax Credit benefits you through tax savings, but how does it work?

The Dependent Care Tax Credit covers up to 35% of qualifying expenses but adjusts based on your income levels. Typically, families earning above $43,000 only receive the minimum of 20% or the cap per child.

If you or your partner are going to school, you’re in luck. Though often tailored to working parents, full-time students are considered employed and can therefore qualify.

Making Camp Galileo an Affordable Dependent Care Option

As summer camp ends and tax season approaches, you prepare to claim this credit. How do you apply for this tax break?

When you file your income taxes, you must complete Form 2441. You’ll need information about the childcare provider, as required by the IRS, including:

- Program or provider name

- Their address

- Their social security number, taxpayer identification number (TIN) or employer identification number (EIN)

This requirement is waived if your care provider is tax-exempt. Your camp should provide all information when asked, but you can file Form W-10 to formally request it if they don’t. Remember to collect all applicable information from your care provider to ensure a smooth filing process.

Reap the (Tax) Benefits of Summer Camp Today

Knowing about the Child Dependent Care Credit allows you to pick a summer camp or day camp that delights your child and saves on taxes. At Camp Galileo, our sessions offer exploration and fun for kids while ensuring your dependent care expenses are beneficial tax-wise.

Enrich your child’s summer with our STEAM-focused camps for grades kindergarten through 8th (Young adults from 8th-10th grade can join our CIT program!) —and receive tax relief in the process—today! Students entering 8th-10th grade can join our counselor-in-training program to gain valuable leadership skills as they progress in their education. Located in Southern California? Be sure to check out our LA, Pasadena, San Diego, Carlsbad, and Orange County summer camps!

Sources:

TurboTax. Deducting Summer Camps and Daycare with the Child and Dependent Care Credit. https://turbotax.intuit.com/tax-tips/family/deducting-summer-camps-and-daycare-with-the-child-and-dependent-care-credit/L8aAzvmjB

IRS. Child and Dependent Care Credit Information. https://www.irs.gov/credits-deductions/individuals/child-and-dependent-care-credit-information

Kiplinger. Does Summer Camp Qualify for a Childcare Tax Credit? https://www.kiplinger.com/taxes/does-summer-camp-qualify-for-a-childcare-tax-credit

Nasdaq. Is Summer Camp Tax Deductible in 2023? https://www.nasdaq.com/articles/is-summer-camp-tax-deductible-in-2023

IRS. Topic No. 602, Child and Dependent Care Credit. https://www.irs.gov/taxtopics/tc602